Corporate Tax Incentives for Energy Efficiency

Increasing energy efficiency has also been facilitated by tenders, subsidies and discounts. Act LXI of 1996 on corporate tax and dividend tax allows companies to reduce their corporate tax liabilities if they implement energy efficiency investments. The energy savings achieved must be at least 10%.

The amounts appearing as allowances in the TAO are determined on the basis of the investment costs as follows, but a maximum of EUR 30 million can be claimed.

The tax allowance is valid for 5+1 years, until the outstanding amount is exhausted.

The following types are distinguished:

- Tax allowance for investments/developments not related to buildings, determined as a percentage of the additional costs compared to a less energy-efficient solution. For example, 30% for large companies in Budapest and 65% for small companies in rural areas.

- In the absence of an alternative solution, determined as a percentage of the total investment cost. For example, 15% for large companies in Budapest and 42.5% for small companies in rural areas.

- Tax relief for investments in buildings is determined as a percentage of the total investment cost. Throughout Hungary, it is 10% for large companies, 20% for medium-sized companies, and 30% for small companies.

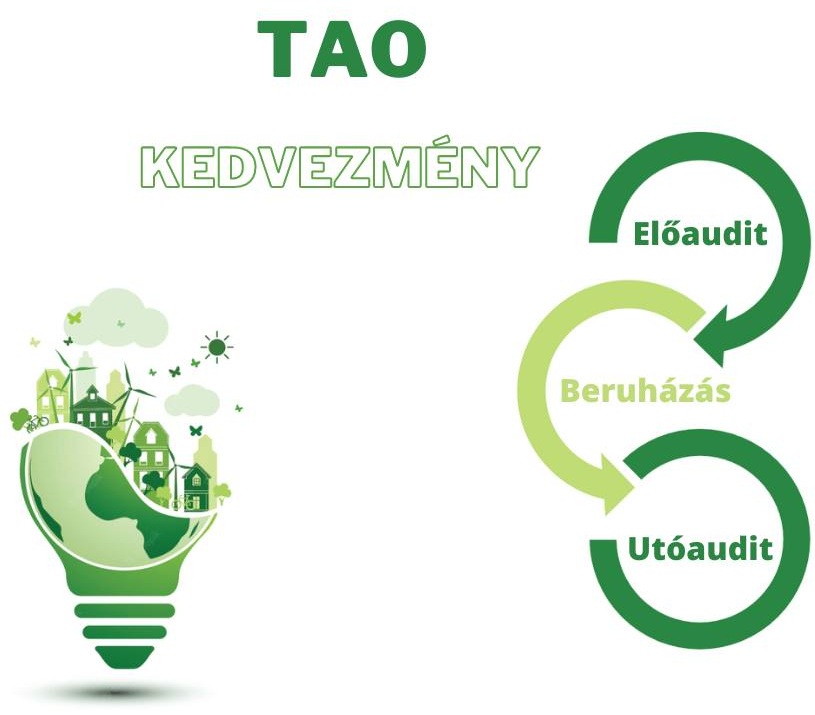

Procedure for claiming TAO relief:

- pre-investment energy efficiency audit carried out by an energy auditor listed in the MEKH register

-

implementation of the investment

-

post-investment energy efficiency audit and notification to the MEKH carried out by an energy auditor listed in the MEKH register.

The energy audit must be based on up-to-date, measured and traceable operational data relating to the energy consumption of the system under review and the load profiles. In the case of energy efficiency investments, only the component where the investment was made needs to be examined.

Benefits of TAO Energy Audit

- Offers actionable insights to enhance energy efficiency, reduce energy consumption, and lower associated costs,

-

Megfelel az energiahatékonysági törvényben és a társasági adóról és az osztalékadóról szóló törvényben foglaltaknak.